Most forex traders are in the dark about what is a realistic win-loss ratio in the forex market. Trading in the forex market is similar to trading in any other financial markets – sometimes you make profit while other times you have to undergo losses. But the question still remains what win – loss ratio should you aim for while trading in the forex market.

Ideal Win Ratio for Trading Gold in Forex Market

Before we go on to reveal a good win-loss ratio to aim for in the forex market, let us know how to calculate the ratio itself. Calculating win-loss ratio in forex is fairly simple. All you need to know is the amount of your wins during a particular period and also the amount of losses you incurred while trading gold in the forex market.

So, suppose that you made a profit of $600 during a particular period while the amount of loss from forex trade comes to $200. In this case your win-loss ratio is 3:1 (600/200).

Most forex trading experts recommend that you should aim for at least 3:1 or 2:1 win-loss ratio. This means that for every $100 invested for trading gold in the forex market, you should look to make a profit of $200-$300.

Although that is the general sentiment in the forex market. However, we feel that the above mentioned win-loss ratio does not hold good for every type of trader. In fact, for some traders it may do more harm than good to their trading account.

The advice of having a win-loss ratio of 3:1 or 2:1 is over simplistic. The reason is that it does not take account the practical realities of the forex market. An ideal win-loss ratio depends on the individuals trading style, in addition to the individual’s statistical expectancy or average profitability per trade (APPT).

Statistical Expectancy or Average Profitability per Trade (APPT)

Statistical expectancy or Average Profitability per Trade (APPT) simply refers to the average amount of wins and lose you can expect in the forex trade. Most people pay too much attention on balancing their profit and loss ratios. They tend to focus so much on the accuracy of their trading approach that they forget to measure performance of their trade. Statistical expectancy or APPT adequately solves this problem.

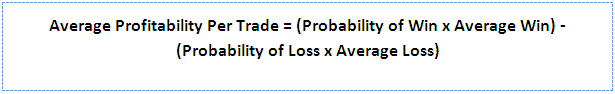

The formula of calculating APPT is depicted in the figure below.

A simple example can help you in understanding how APPT is calculated. Suppose that out of 20 trades, you make a profit on six. Your probability of a win therefore is 30% or 0.3, while your probability of loss equals 70% or 0.7. Also suppose that the amount of profit you make from the forex trade equals $800 while loss amounts to $400. In this scenario, the APPT is calculated as follows.

(0.3*800) – (0.7*400) = -$40

The APPT in this scenario is a negative number. It means that for every trade you make, you are likely to lose $40. This is a losing trading position for you. Although your win-loss ratio amounts to 2:1 (800/400), your losing trade percentage is high (70%). As a result you are not in a profitable position.

Now suppose that out of 20 trades, you make a profit on sixteen. Your probability of a win is 80% or 0.8, while your probability of loss equals 20% or 0.2. Also, suppose that the amount of profit you make from the forex trade equals $300 while loss amounts to $900. In this scenario, the APPT is calculated as follows.

(0.8*300) – (0.2*900) = $60

Now, the APPT is a positive number. It means that for every trade you make, you are likely to gain $60. This is a profitable trading position for you. Although your win-loss ratio amounts to 1:2 (900/300), your winning trade percentage is high (80%). As a result you are in a profitable position.

In the first example, the trader is risking a lot while making very little profit. Although the win-loss ratio in terms of actual profit is 2:1, yet the trader is still on a losing side as the winning percentage of trades is less. If the trader goes on making trades with the strategy, eventually he or she will incur a net loss on trades.

Contrarily, in the second example the trader incurs a net loss from the trade, but still the overall winning percentage is high. Here the strategy of the trader is more profitable as compared to previous example. The trader will earn a net profit from the trade, if he or she goes on making trades using the current strategy.

Conclusion

Trading profitably in forex is not just about having a good win-loss ratio. What is more important is a high probability of realizing a winning trade. The statistical expectancy or average profitability per trade (APPT) is the real measure of success that determines whether you will remain profitable or incur losses as you trade in gold in the forex market.